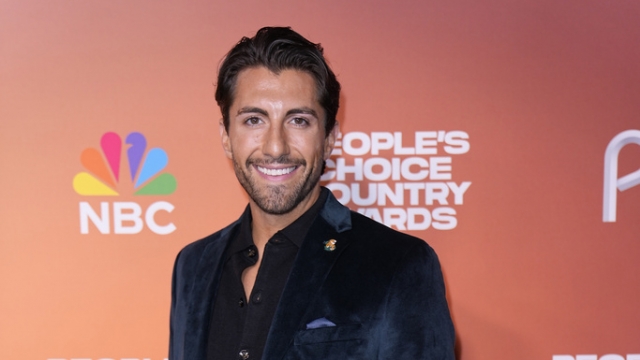

You may remember Jason Tartick back when he was looking for love on "The Bachelorette," but before he was collecting roses, he was crunching numbers as a banker.

And now he is sharing some financial insights through his new book, "Talk Money to Me," mostly when it comes to relationships.

Discussing money in relationships can be awkward, but Tartick says it's crucial and these conversations should not be avoided.

To broach the topic positively and early on without causing worry, focus on openness, understanding, and shared financial goals, he says.

"One of the theories I have of why we don't talk about it, is because we were never taught it. So for us to talk about something we were never taught and then told not to talk about, is something that we know is creating massive, massive, issues and ripples in our relationship. It's the second-leading reason for divorce — 73% of couples that say they're having material-money arguments are saying that their intimacy is down 50%," said Tartick, adding that there are ways to talk about the topic in conversations in a fun way.

"Introduce money in a fun and easy way. You can even do it on a first date. So you can ask someone, 'Okay, if you win $10,000 today, you gotta spend every dollar literally today, what are you going to spend it on? Or if you had to define your money relationship or your money behaviors In three words, what would you say?' ... There are ways to introduce money topics that aren't so scary and tough conversations to have," Tartick explained.

In his book, he also shares the story of a woman deceived by her ex-boyfriend, who had a $57,000 tax lien from a previous marriage, and Tartick explains what kind of red flags we need to look out for.

"The number one reason why people get divorced is infidelity. So if people are committing financial infidelity, there's a huge correlation to infidelity. So if we see people lying about their financials, they might be lying elsewhere. The other thing I tell people is to do your due diligence and don't do it through interpersonal loans and interpersonal contracts," Tartick said.

Tartick suggests that a simple step you could take is to pull each other's credit scores and compare them, exploring how you can work together as a couple to enhance them.

SEE MORE: Suze Orman: Why many women struggle to save money

Trending stories at Scrippsnews.com